cryptocurrency tax calculator canada

If you buy the cryptocurrency in a 30 day window either. Cryptocurrency is a term that refers to all digital currency but within this term there are many different types of coins and tokens such as.

Bitcoin Tax Calculator Easily Calculate Your Tax Obligation Zenledger

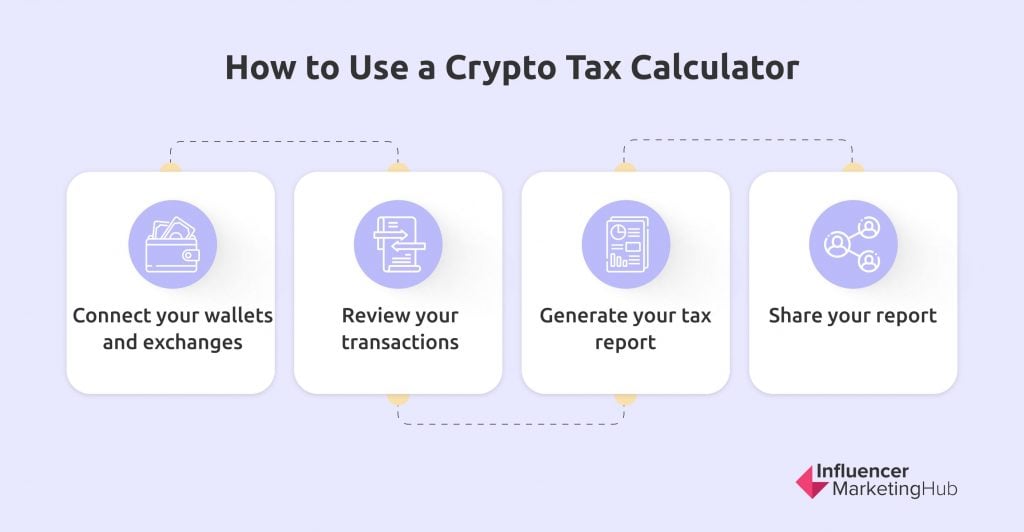

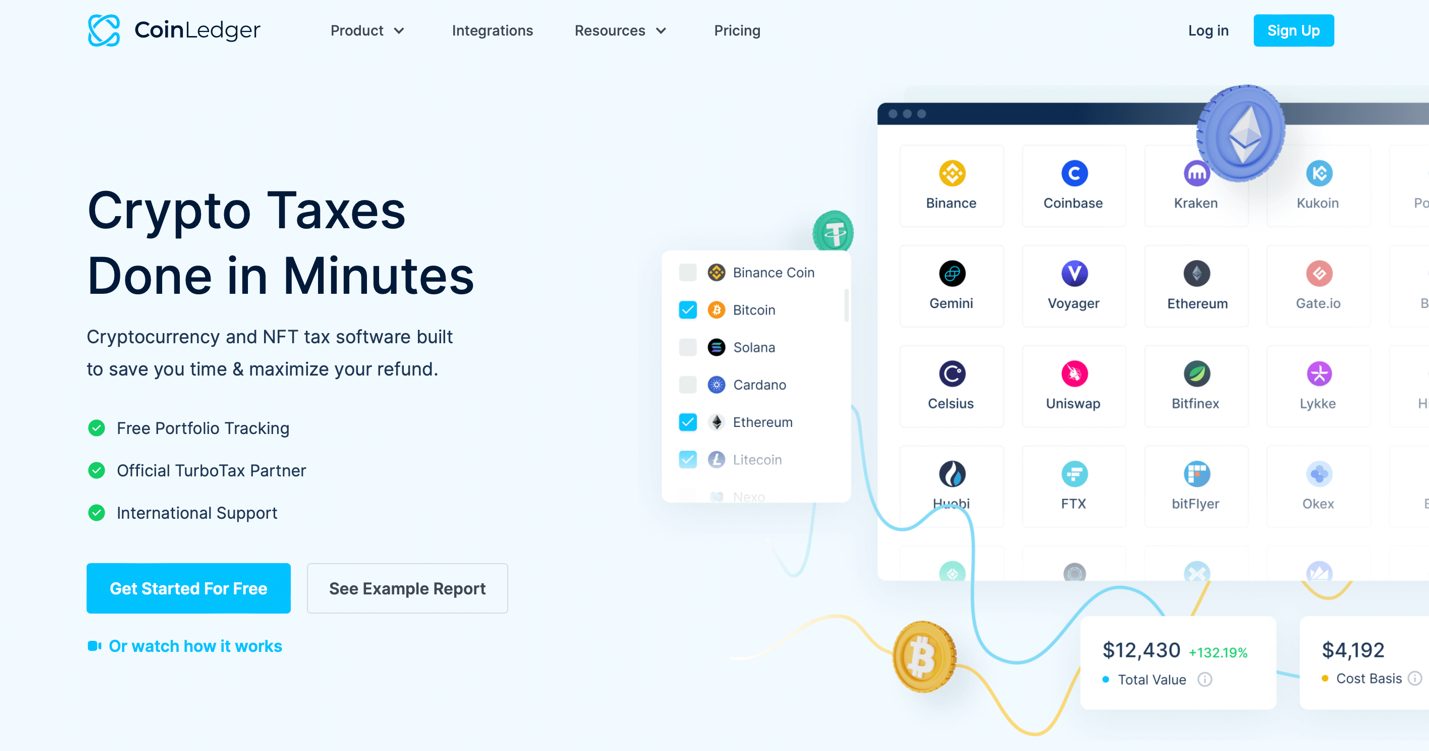

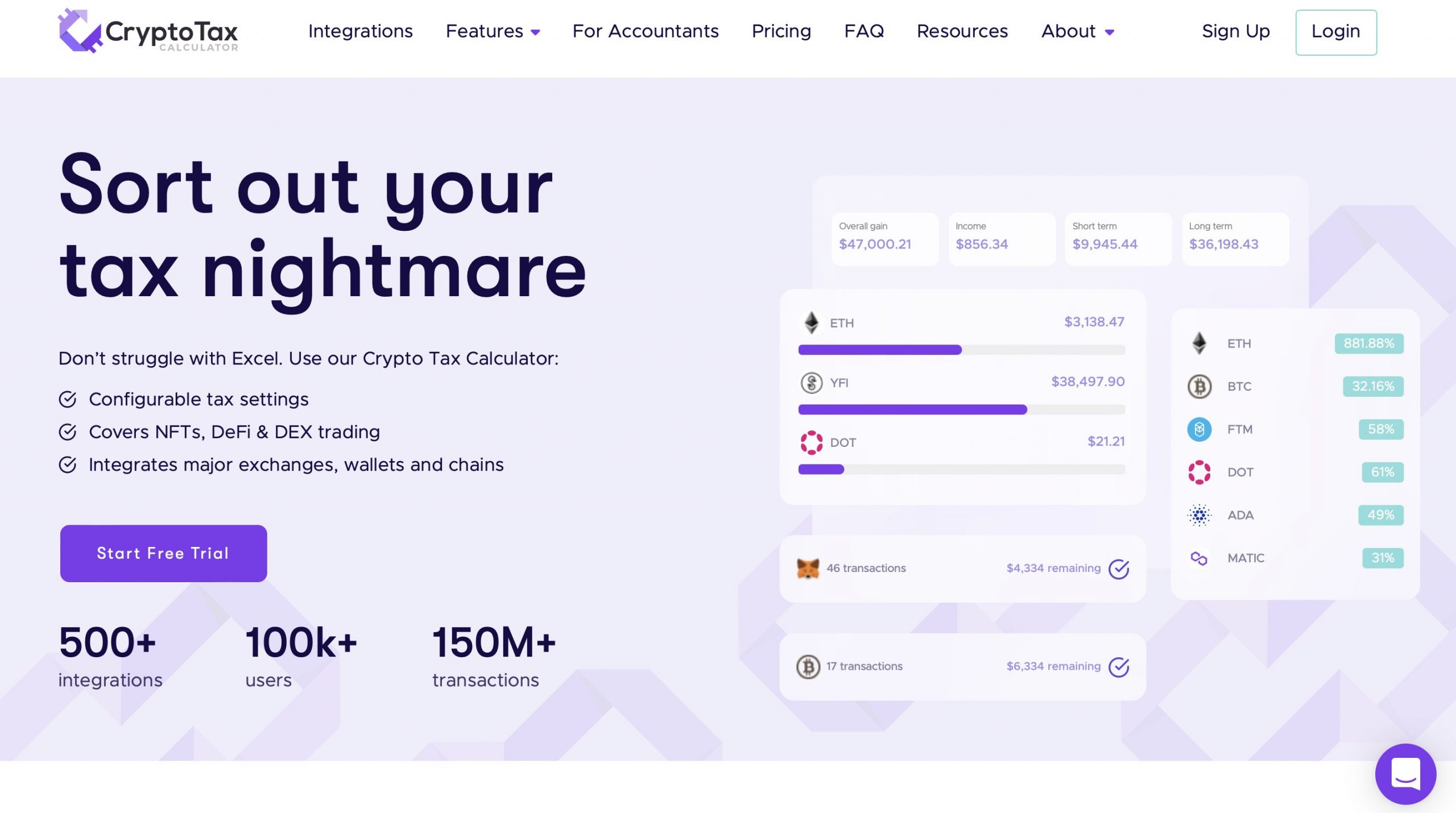

Thats why most people use a cryptocurrency tax calculator like Coinpanda to handle this and generate all required tax reports and forms automatically.

. Cryptocurrency and Bitcoin Taxes. Using our cryptocurrency tax calculator you can determine your estimated capital gains tax liability by entering a few pieces of information. Our platform allows you to import transactions from more than 450 exchanges and.

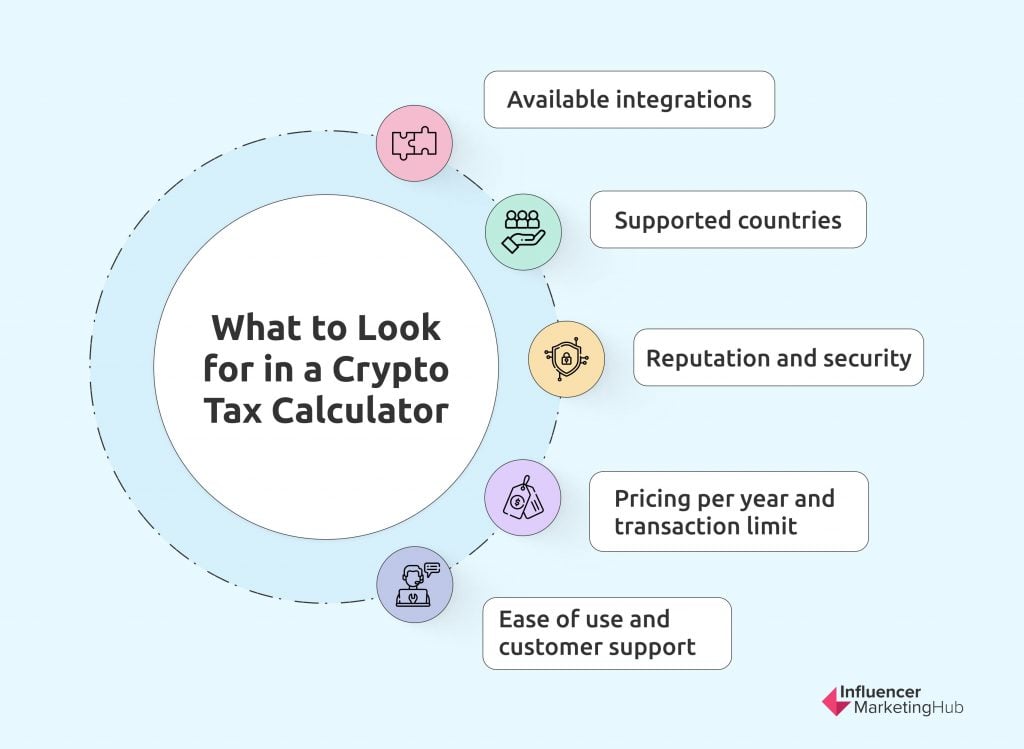

Toggle menu toggle menu path. Cryptocurrency Tax Calculator. 15 Best Crypto Tax Softwares Calculators in 2022.

Crypto taxes in Canada are confusing because there are so many use cases for crypto. If your only income is through crypto the basic personal amount allows you to earn 13808 before you need to pay taxes. Coinpanda is the worlds most easy-to-use cryptocurrency portfolio tracker and tax software.

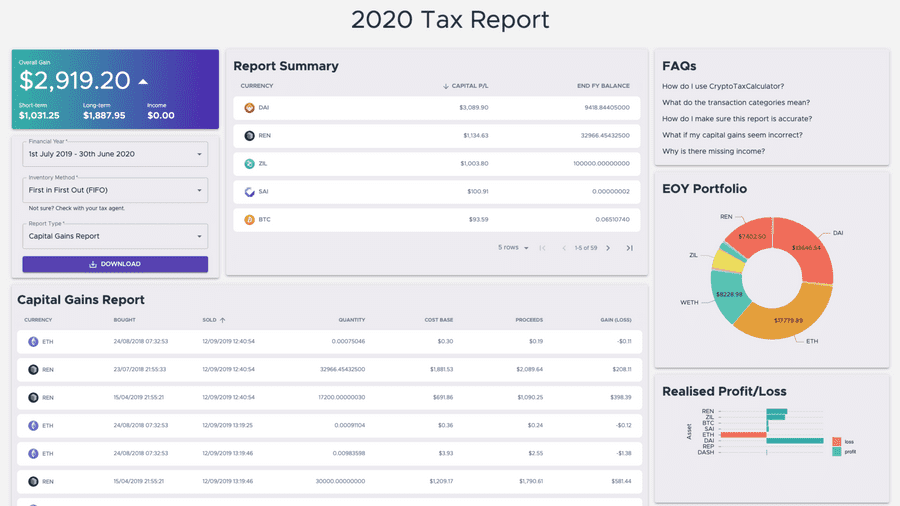

Check out our free Cryptocurrency Tax Interactive Calculator that in just one screen will answer your burning questions about your cryptocurrencyBitcoin sales and give. In the last tax year you sold 400000 worth of crypto for 100000 of profit. Cryptocurrency is a relatively new innovation that requires guidelines on taxation so that Canadians are aware of how to meet.

This means you may owe taxes if your coins have increased in value whether youre using them as an investment or like you would cash. You can use crypto as an investment as a currency for spending or as a source of passive income. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate.

Straightforward UI which you get your crypto taxes done in seconds at no cost. As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while. For income tax purposes the Canada Revenue Agency treats any income you earn from transactions involving cryptocurrency as business income or capital gains depending on.

Cryptocurrency Tax Calculator. Binance Malta Kucoin Singapore Bitfinex Hong Kong China Jaxx Canada and Huobi. You derive the majority of your income from cryptocurrency day trading.

If you are using cryptocurrency to invest you will be taxed on the capital gains when you sell it. Learn how to calculate and file your taxes if you live in Canada. Find out how the CRA treats cryptocurrency in Canada with our straightforward guide on crypto taxes for both individuals and businesses.

If your total income exceeds CAD 98040 youll pay a base tax of CAD 17402 and an additional 26 will be charged on all income that falls between CAD 98041 and CAD 151978. The basic personal amount. Cryptocurrency is taxed as capital gains.

The CRA says Capital gains from the. Keep reading to learn more about. Tax-Loss Harvesting With A Crypto Tax Calculator.

This tactic is known as tax loss harvesting and to circumvent this the CRA introduced the superficial tax loss rule. Crypto tax calculators are essential for every trader and throughout this article we will cover the best crypto tax. The amount of tax you pay on crypto in Canada depends on whether you are considered to be operating a crypto business or simply trading crypto for capital gains.

It is important to understand cryptocurrency conditions tax laws and reporting. Koinly is the only cryptocurrency tax calculator that is fully compliant with CRAs crypto guidance. Use our crypto tax calculator below to.

Guide for cryptocurrency users and tax professionals.

11 Best Crypto Tax Calculators To Check Out

Cryptocurrency Tax Guides Help Koinly

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

11 Best Crypto Tax Calculators To Check Out

How To Calculate Cryptocurrency Taxes Using A Crypto Tax Calculator Zenledger

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Top 8 Crypto Tax Software Alternatives To Cointracking Updated 2021 Coincodex

Cryptocurrency Tax Calculator Forbes Advisor

How To Calculate Crypto Taxes Koinly

11 Best Crypto Tax Calculators To Check Out

Crypto Tax Calculator Review August 2022 Finder Com

Cryptocurrency Taxation In Canada In 2022 Cryptocurrency Capital Assets Goods And Services

11 Best Crypto Tax Calculators To Check Out

11 Best Crypto Tax Calculators To Check Out

11 Best Crypto Tax Calculators To Check Out

Investment Tracker At A Glance With Cryptocurrencies Nfts Etsy Canada In 2022 Investing Investing For Retirement Google Sheets

Calculate Your Crypto Taxes With Ease Koinly

How Fees Can Lower Your Income Tax Koinly

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income